Describe the Use of Internal Rate of Return

The Internal Rate of Return Method. It is used to evaluate how attractive a specific investment or project happens to be.

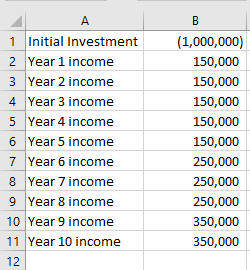

How To Use The Excel Irr Function Exceljet

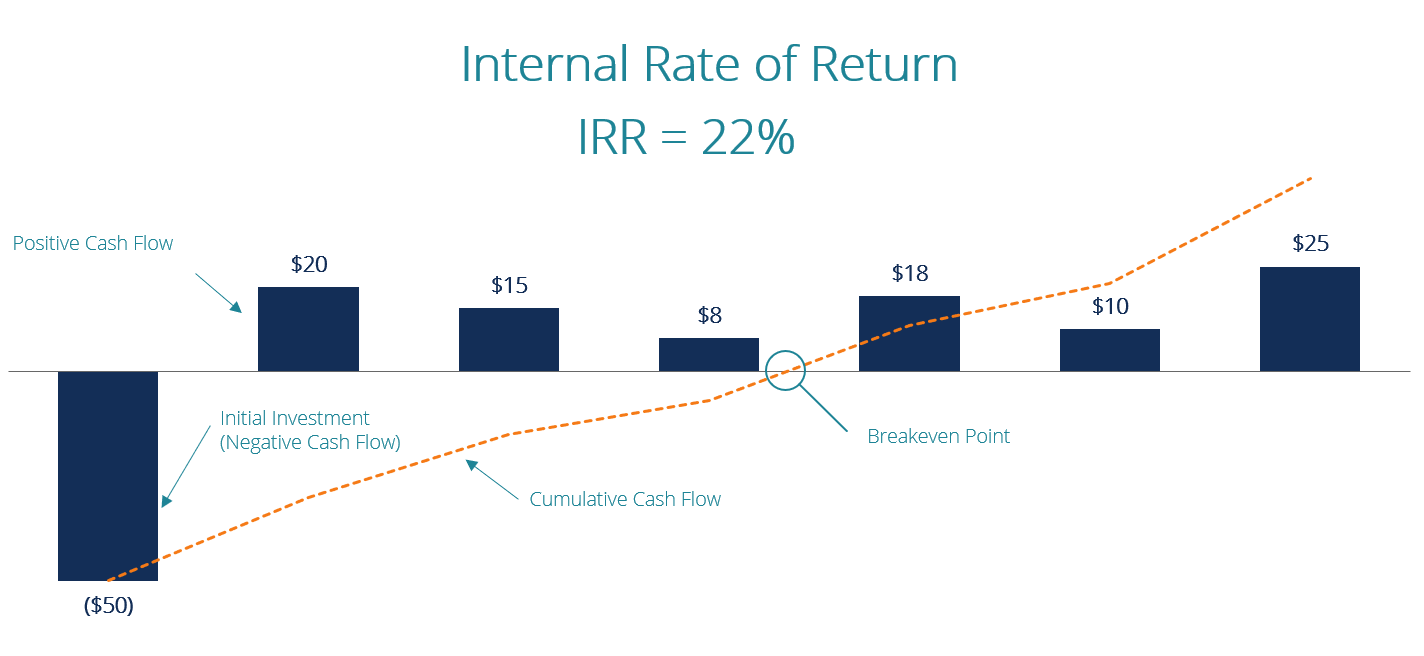

IRR involves positive and negative cash flows.

. Internal rate of return commonly abbreviated IRR is used to measure an acceptable level of return for an investment by equating a net present value rate of zero to the investment. If the IRR is greater than or equal to the companys required rate of return often called the hurdle rate the investment is accepted. By looking at the rate of return we expect on an investment over the life of the investment we can figure out the internal rate of return.

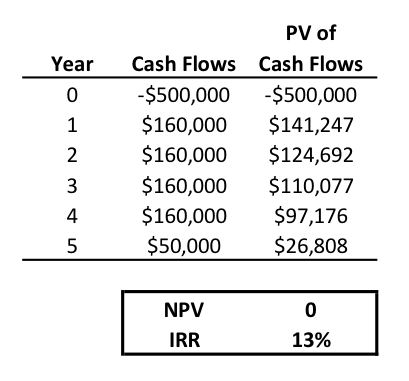

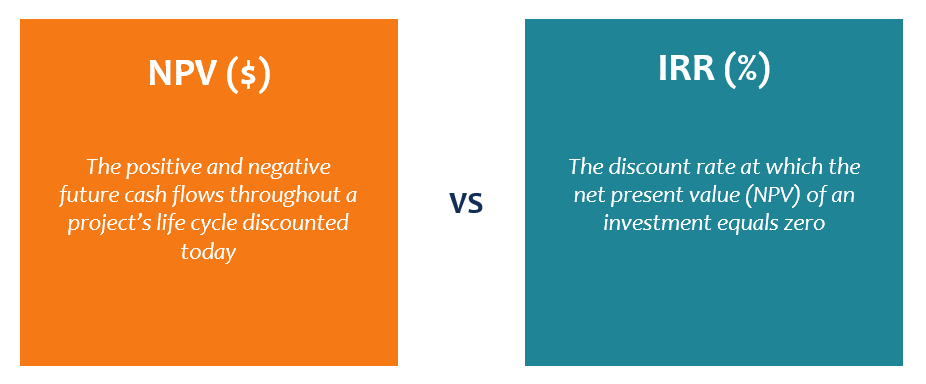

The cost of capital is used as the discount rate when computing the net present value of a project. Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flows. It considers the time value of money even though the annual cash inflow is even and uneven.

Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flows. Of a project zero. In other words it is the expected compound annual rate of return that will be earned on a project.

2200 Posted By. By looking at the rate of return we expect on an investment over the life of the investment we can figure out the internal rate of return. The purpose of this assignment is to allow the student to calculate the project cash flow using net present value NPV internal rate of return IRR and the payback methods.

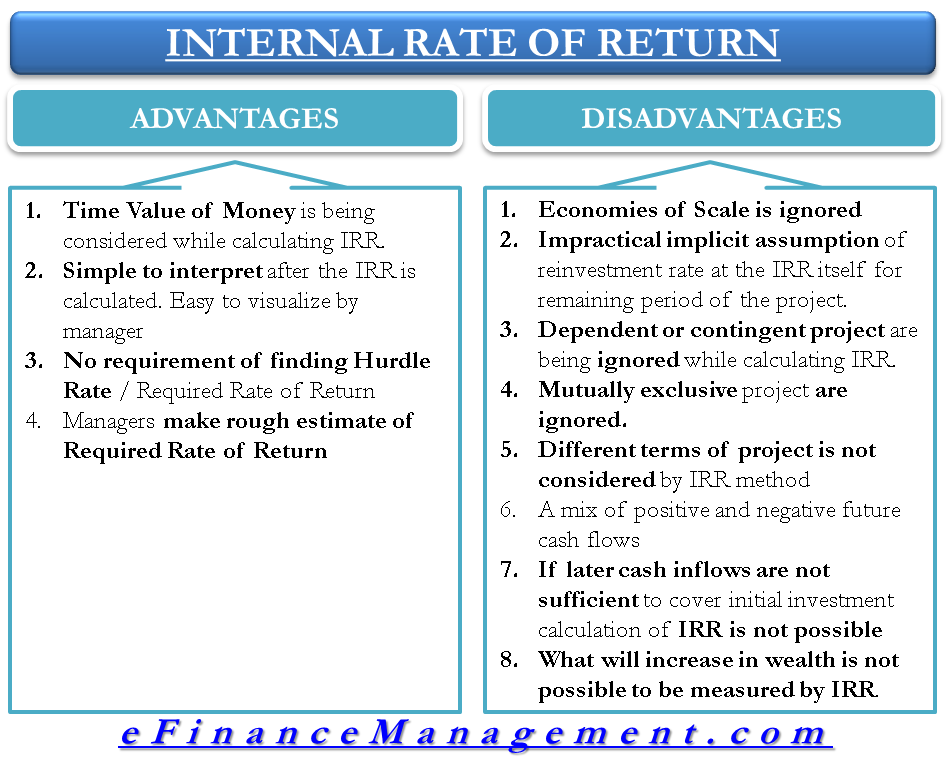

A brief explanation of advantages of Internal Rate of Return method is presented below. 07092017 1225 AM Due on. In this way a true profitability of the project is evaluated.

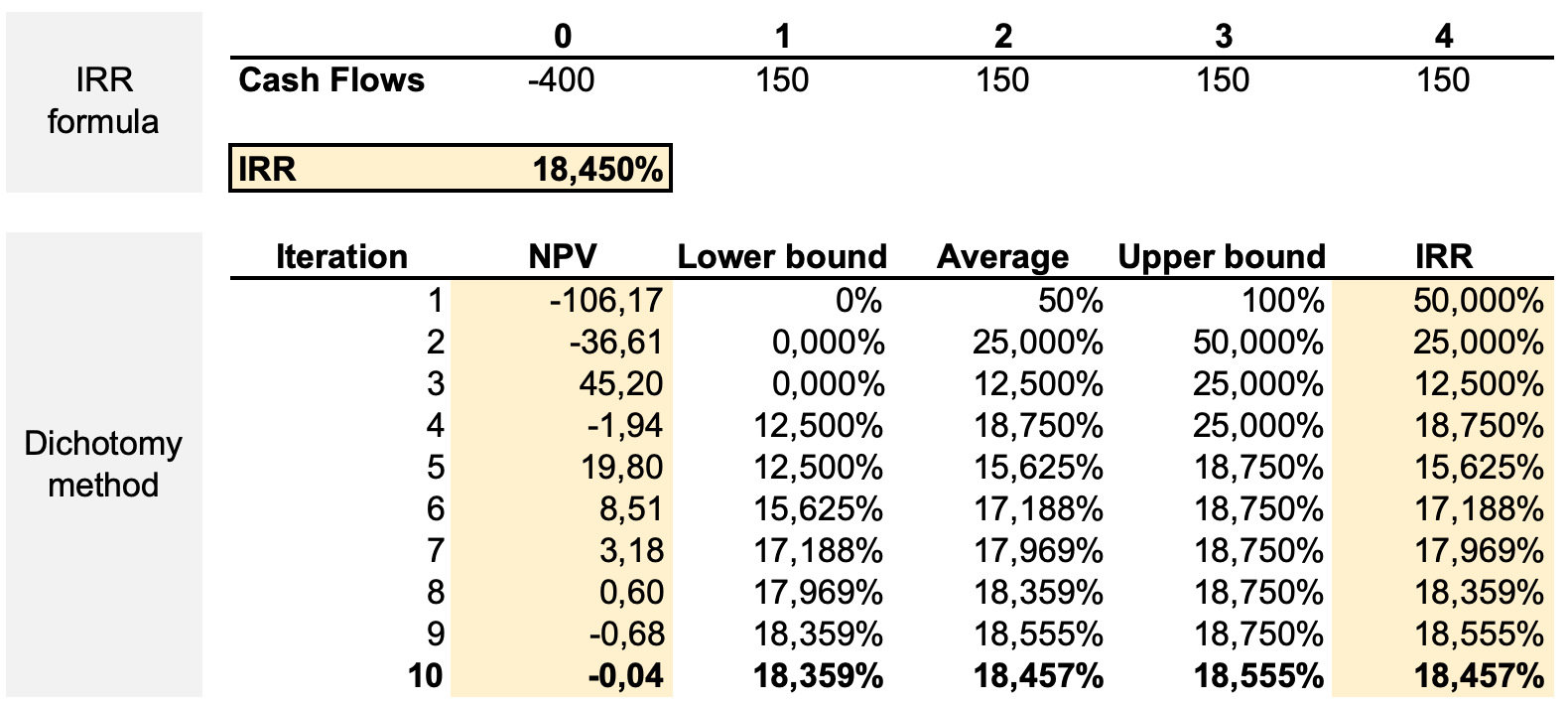

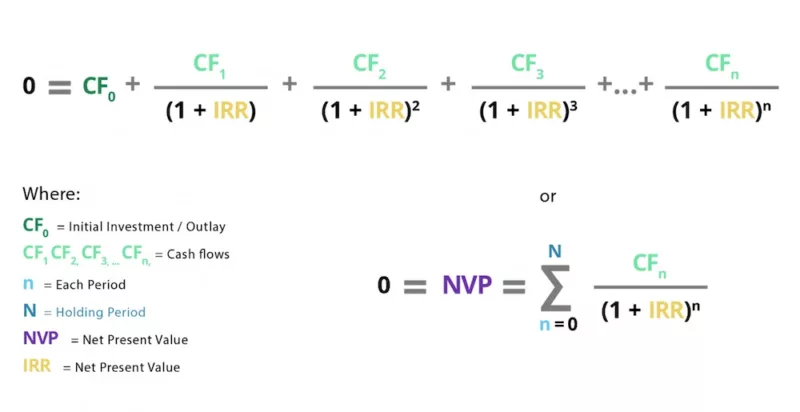

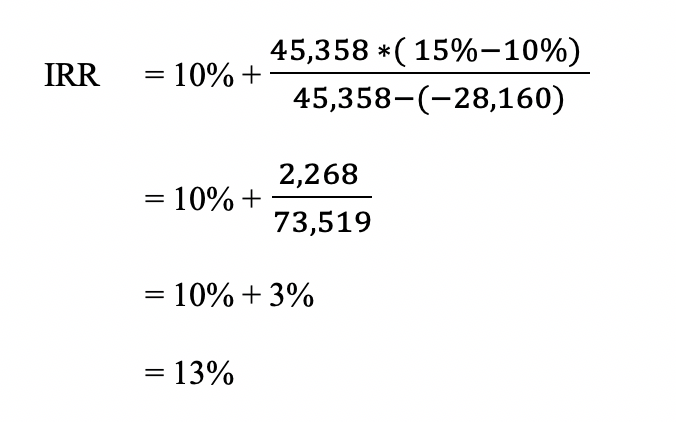

So this method uses the discount rate that equals the present value of cash outflows with cash inflows resulting in a net present value of zero. It is also called the discounted cash flow rate of return DCFROR or the rate of return ROR. The internal rate of return IRR is a metric used in capital budgeting to estimate the return of potential investments.

Describe the use of internal rate of return IRR net present value Offered Price. It is the discount rate at which the present value of a projects net cash inflows becomes equal to the present value of its net cash outflows. The internal rate of return IRR is a financial metric used to assess the attractiveness of a particular investment opportunity.

1000 Posted By. Describe the use of internal rate of return IRR net. Describe the advantages and disadvantages of each method.

In other words internal rate of return is the discount rate at which a. The internal rate of return or IRR is the interest rate where the net present value of all cash flows from a project or an investment equal zero. The Internal Rate of Return IRR is the discount rate that makes the net present value NPV Net Present Value NPV Net Present Value NPV is the value of all future cash flows positive and negative over the entire life of an investment discounted to the present.

Create a 350-word memo to management including the following. More How Money-Weighted Rate of Return Measures Investment Performance. This method goes back to the time-value of money.

In other words management uses the internal rate of return to develop a baseline or minimum rate that they will accept on any new investments. This method goes back to the time-value of money. So this method uses the discount rate that equals the present value of cash outflows with cash inflows resulting in a net present value of zero.

The cost of capital is compared to the internal rate of return promised by a project. The other money-weighted return figure displayed in your account is the internal rate of return or IRR for short. The internal rate of return IRR or economic rate of return ERR is a rate of return used in capital budgeting to measure and compare the profitability of investments.

The purpose of this assignment is to allow the student to calculate the project cash flow using net present value NPV internal rate of return IRR and the payback methods. 07092017 Question 00558481 Subject Finance Topic Finance Tutorials. This method goes back to the time-value of money.

Calculate the following time value of money problems. Describe the use of internal rate of return IRR net present value NPV Offered Price. It is certainly more useful than the simple earnings figure.

The IRR is the rate required r to get an NPV of zero for a series of cash flows and represents the time-adjusted rate of return for an investment. Otherwise the investment is rejected. By looking at the rate of return we expect on an investment over the life of the investment we can figure out the internal rate of return.

11132019 Question 00743579 Subject Education Topic General Education Tutorials. 11132019 1221 PM Due on. Any project with a negative net present value is rejected unless other factors dictate its acceptance.

So this method uses the discount rate that equals the present value of cash outflows with cash inflows resulting in a net present value of zero. IRR Internal Rate of Return is a yardstick to calculate or estimate the rate of return for an investment in the future. The profitability of the project is considered over the entire economic life of the project.

The internal rate of return sometime known as yield on project is the rate at which an investment project promises to generate a return during its useful life. It is a discount rate which makes NPV net present valueof all cash flow positive and negative funds equivalent to. But it is also not the best figure to use to understand how well Betterment is managing your money TWR is because it includes the impact of your deposits and withdrawals.

Calculate Irr Formula With Excel With Screenshots

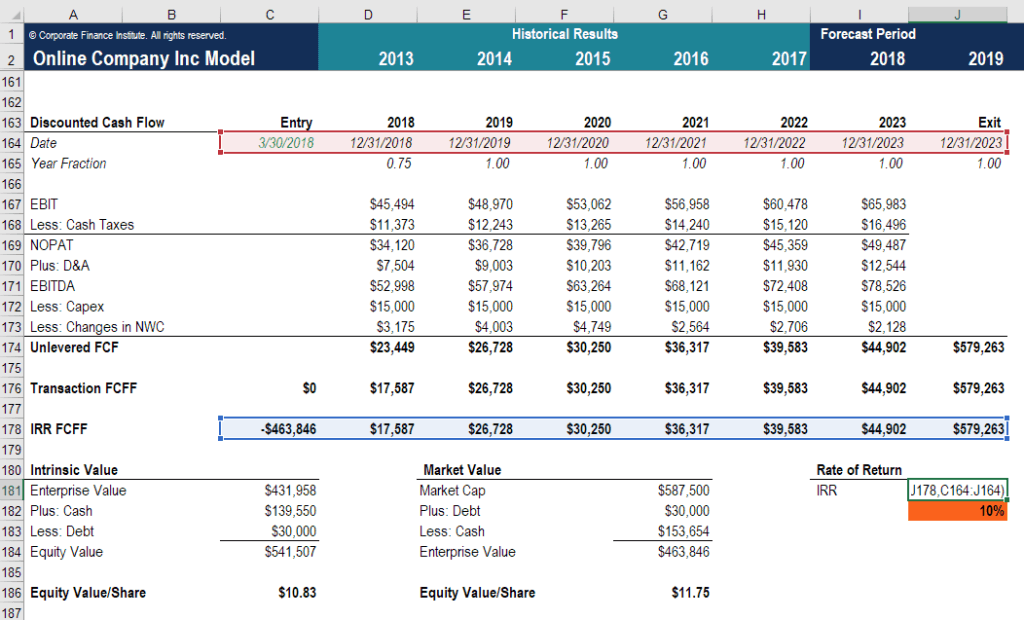

Internal Rate Of Return Irr A Guide For Financial Analysts

Advantages And Disadvantages Of Internal Rate Of Return Irr Efm

The Internal Rate Of Return Simtrade Blogsimtrade Blog

How To Calculate Irr Using Trial And Error Youtube

Internal Rate Of Return Irr A Guide For Financial Analysts

Microsoft Excel 3 Ways To Calculate Internal Rate Of Return In Excel

Irr Function Formula Examples How To Use Irr In Excel

Internal Rate Of Return Irr A Guide For Financial Analysts

Internal Rate Of Return Irr A Guide For Financial Analysts

Internal Rate Of Return Formula Definition Investinganswers

Internal Rate Of Return Irr Formula And Excel Calculator

Internal Rate Of Return Formula Example Excel Accountinguide

The Internal Rate Of Return Ffm Foundations In Financial Management Foundations In Accountancy Students Acca Acca Global

Calculate Irr Formula With Excel With Screenshots

Calculate Irr Formula With Excel With Screenshots

The Internal Rate Of Return Ffm Foundations In Financial Management Foundations In Accountancy Students Acca Acca Global

Comments

Post a Comment